Last week my attention was caught by PTC’s announcement of Windchill+. Here is a piece of information I captured from the PTC Newsroom – PTC Accelerates Customers’ Journeys to SaaS with New Windchill+ Offering. I found the news interesting to dig more inside to understand what is Windchill+ and how is this new release related to the PTC Atlas Platform and overall SaaS strategy.

Windchill+ Announcement

According to Jim Hepplemann Windchill was empowered manufacturing organizations for more than two decades and now can leverage modern SaaS architecture.

“For more than two decades, many of the world’s most sophisticated manufacturing companies have used Windchill to design, develop, and manufacture their products,” said Jim Heppelmann, President and CEO, PTC. “Windchill+ unleashes an exciting new future for our Windchill product line, delivering the full digital transformation power of PLM while simplifying deployment, usage, and upgrades through the use of a modern SaaS architecture.”

At first glance, this is a very predictable step done by PTC that can make Windchill Hosted Cloud solution similar to steps done by PTC competitors Siemens (TeamcenterX) and Aras (Aras Enterprise SaaS). If you missed my earlier article, please check it here – PLM SaaS-ification.

Windchill+ and PTC Atlas?

Engineering.com article written by Verdi Ogewell gives you a perspective on what it is called – PTC’s New Aggressive SaaS Plan: Sell a Portion of Services Business to ITC and Buy ALM Company Intland for $280 Million. The article speaks about Windchill+ and actually connects it to the PTC Atlas platform, which was a surprise for me. Here are a few passages from the article:

“SaaS is of course a big priority,” Heppelmann says. “And Atlas plays an important role in the architecture we want for SaaS. We would like to have CAD and PLM, sub-areas like ALM, and so forth to work seamlessly together in Atlas’ SaaS environment. We want to offer a fully integrated experience here, where customers can work seamlessly without having to set anything up.”

“Now that we have these new capabilities in the cloud available, Windchill+ which runs on Atlas, we will sell it to new customers starting immediately, but also to old customers that bought Windchill on-premise and wish it was in the cloud. We want to do a conversion and convert those Windchill on-premise systems into the running SaaS system. In this context we use the term “lift and shift.” We want to lift those systems and shift them into the cloud. That’s a services project. The systems need to be upgraded—some of them can be several versions behind—and in some cases we also want to get rid of old customizations that are no longer needed which we don’t want to put in the cloud environment. Each of these lift and shift projects is really an upgrade, de-customization and a shift. We have more than 5,000 of these systems running at customer’s sites. We’re talking over time and over years here, about thousands of customer projects,” Heppelmann says.

This tells us a lot about the significance Atlas has as a cloud and SaaS platform foundation for PTC’s PLM tools. Not only as a “carrier” of the Onshape cloud CAD solution PTC bought a couple of years ago, but also for the classic Creo CAD software, Windchill PLM+, Arena PLM and sub-PLM areas like ALM and the Intland Codebeamer.

Engineering.com message is actually appearing to be very confusing because it gives you a perspective that Windchill+ runs on the Atlas platform. Reading the PTC announcement I thought that Windchill+ is just an automated hosting of Windchill, but according to Engineering.com, it is not.

PTC Atlas and SaaS-ification

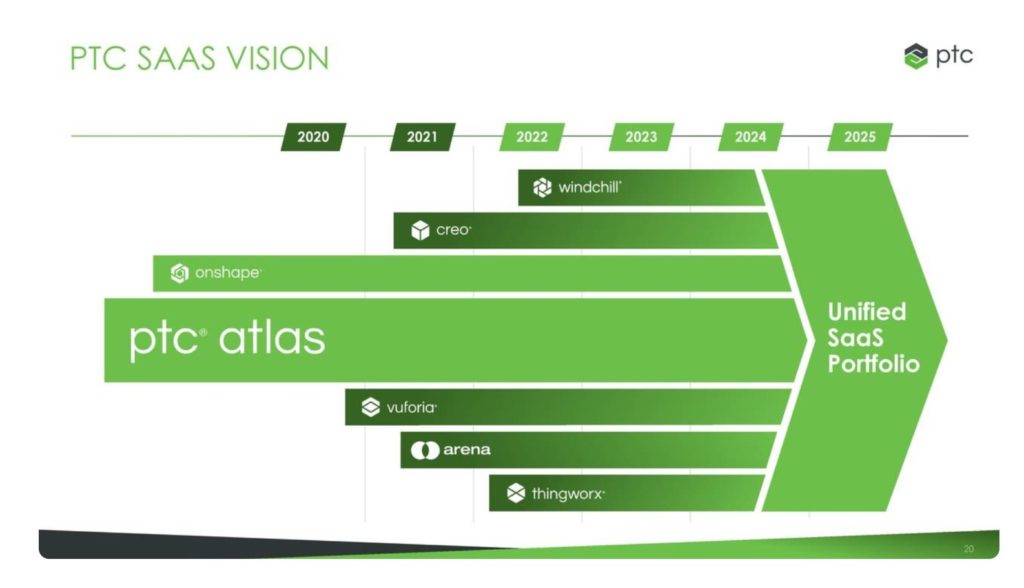

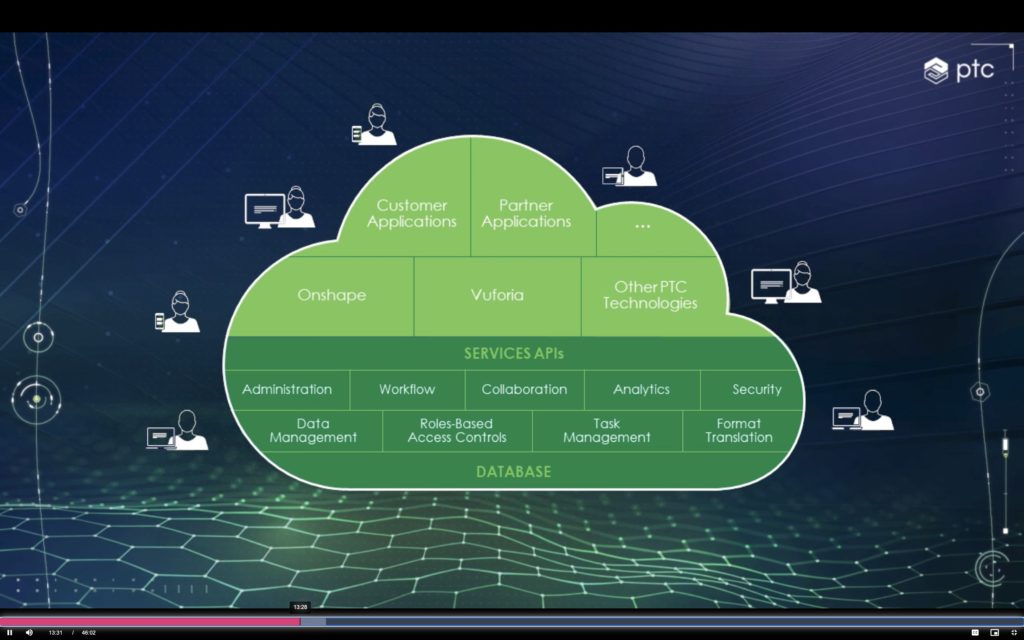

PTC Atlas name and the platform was born together with the Onshape acquisition. In my view, Atlas is an Onshape data management (Cloud PDM) platform, which is a foundation for Onshape CAD that PTC planned to generalize to deliver additional capabilities. I actually applauded this strategy, because, in my view, Onshape is a great platform to build a multi-tenant PLM architecture of the future. PTC actually promised to convert all products to Atlas by 2025.

I’d love to get PTC updated about the progress of SaaS-ification. The only thing I found so far is the announcement about the delivery of Vuforia and Generative Design on the Atlas platform.

PTC has expanded its software as a service (SaaS) capabilities with two new products shipping on the PTC Atlas SaaS platform. Atlas, announced at the LiveWorx 2020 Digital Transformation Conference, now supports an expanding portfolio of SaaS applications and production-ready solutions. With the Vuforia Expert Capture and Creo Generative Design Extension (GDX) offerings joining the existing Onshape offering on Atlas, PTC continues to accelerate availability of SaaS products in the market.

According to the PTC chart above you can think products like Arena, Creo and Windchill will become available on the Atlas platform. That would be really interesting and a big technical step for PTC. However, I didn’t find any public news and architectural details about that, except Engineering.com article speaking about Windchill+ and Atlas.

Windchill+Arena = SaaS PLM?

Announcements of Windchill+ increased the amount of SaaS PLM assets PTC can provide. While I still believe Windchill+ is just a hosted version of Windchill, Arena PLM acquired back in 2020 is well known SaaS application, which goes back at the beginning of 2000s as bom.com.

This raises an interesting question about how PTC will be combining Windchill+ and Arena to run on Onshape’s SaaS platform. As much as I believe in the transformative power of modern SaaS technologies, these platforms represent multiple different technological stacks, database foundations, and technologies.

According to some public sources, Onshape uses MongoDB as a foundation of data storage, which is most probably enhanced by additional NoSQL databases that combined with Onsahpe modern multi-tenant architecture capable to scale as a global platform. Arena PLM foundation is much older and technologies used for Onshape were not born when Arena was created. I was not able to find public information about the Arena tech stack, but my guess would be that Arena runs on Oracle DB and the web architecture stack of the 2000s, which is capable to provide a multi-tenant server foundation. However, Windchill is strictly single-tenant architecture that goes back another decade from Arena.

I’d be very much interested to ask questions about PTC’s strategy to combine all these pieces of software into a set of services plugged into Atlas. However, my prediction is that combining these three pieces of technology will be mission impossible and PTC will have to find another way to empower Atlas and Onshape with PLM capabilities to satisfy the growing needs of Onshape customers.

Time will show more and we can only compare it to similar tasks made by other PLM vendors before. There are only two platform transformations that were done in the past – Teamcenter Unified (which was built on Teamcenter Engineering bypassing Metaphase architecture) and 3DEXPERIENCE/ENOVIA (which was built on top of MatrixOne causing to eliminate earlier ENOVIA LCA architecture completely). In both cases, a single platform is used as a foundation basically eliminating the rest. So, what will become a foundation in the case of PTC? It looks like PTC will make some urgent strategic decisions in the near future.

PTC SaaS and PLM Market

Any technology is as good as the market you can apply it to. Without an applicable market, even the greatest technology can die. What is the market for PTC SaaS? Article PTC perspective on SaaS Tipping Point you can find some ideas about directions PTC can take.

According to PTC findings, SaaS CAD and SaaS PLM are the main elements of the foundation as a solution to bringing SaaS to the manufacturing industry, 91% of companies are looking for SaaS CAD and 90% of companies are looking for SaaS PLM. The research covers SME companies that are the target of PTC Onshape and Arena PLM applications. According to PTC, Onshape+Arena is a complete CAD+PLM SaaS solution.

The reality is that SME is a place with a super strong competition against the status quo represented by desktop CAD systems (eg. Solidworks), old PDM systems (eg. PDM Professional), and new solutions coming from large vendors DS 3DEXPERIENCE, Autodesk Fusion360 and several startups (eg. OpenBOM, Propel).

What Is My Conclusion?

PTC has super aggressive SaaS plans. It spent a substation amount of resources and money to acquire technologies and companies to do so. It would be very interesting how PTC will be building their modern SaaS PLM puzzle from these pieces of technologies and products of various ages and technologies. The most reasonable approach would be extending Onshape/Atlas with compatible technologies and services seamlessly integrated into a common platform with scalable data services, compatible database architecture, and collaboration capabilities Onshape provides today. Time will show what path PTC Architects and management will be taking. The opportunity for PTC is to sell into the traditional SME market and switch existing desktop and client-server solutions to new PTC SaaS. Will PTC be able to execute market strategy and provide tools to perform such a switch, this is a question. The jury is out to watch the results. Just my thoughts…

Best, Oleg

Disclaimer: I’m co-founder and CEO of OpenBOM developing a digital cloud-native PLM platform that manages product data and connects manufacturers, construction companies, and their supply chain networks. My opinion can be unintentionally biased.

The post Windchill+, Atlas, and PTC SaaS Trajectories appeared first on Beyond PLM (Product Lifecycle Management) Blog.

Be the first to post a comment.